Run your installment business like a pro.

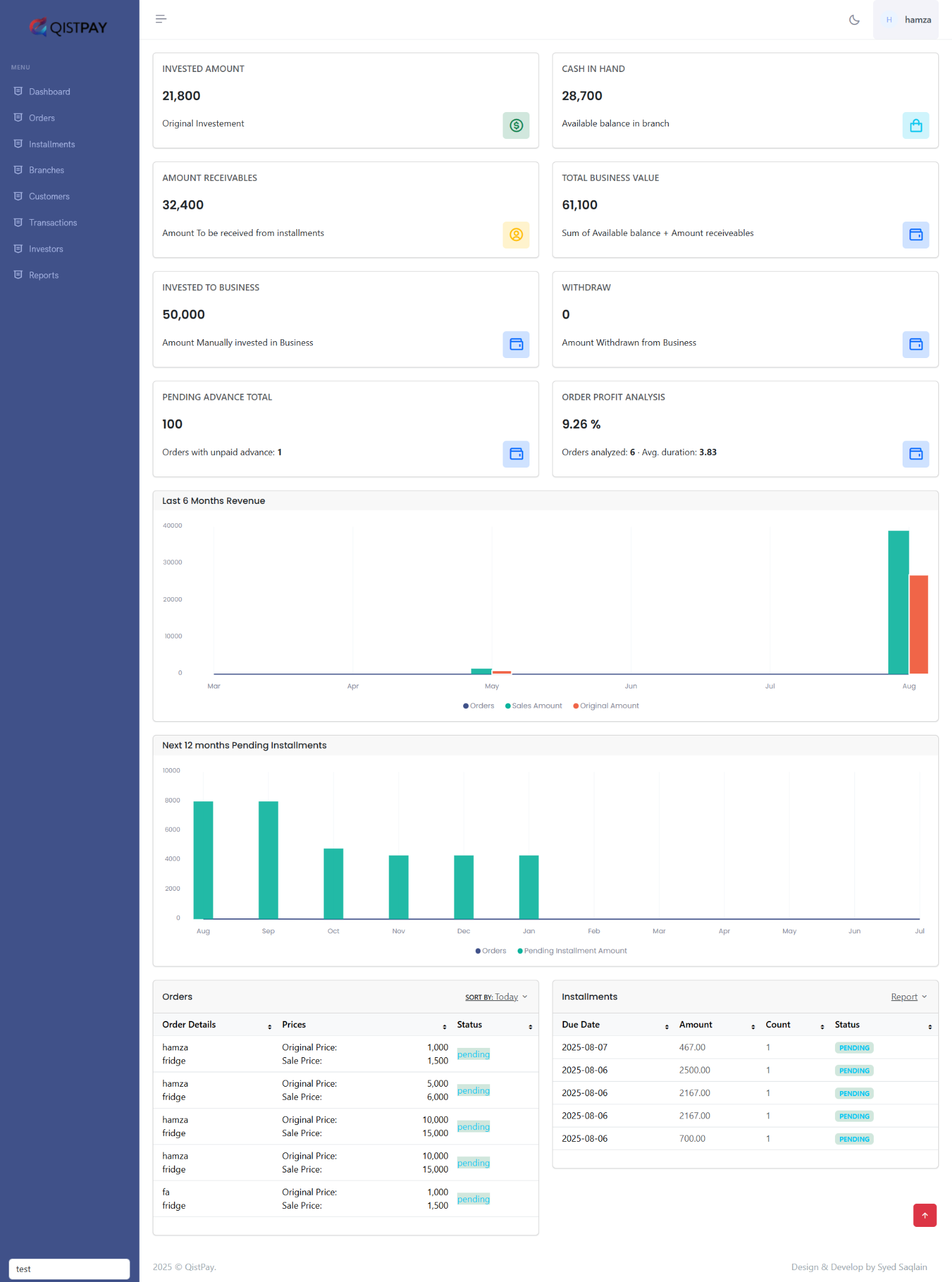

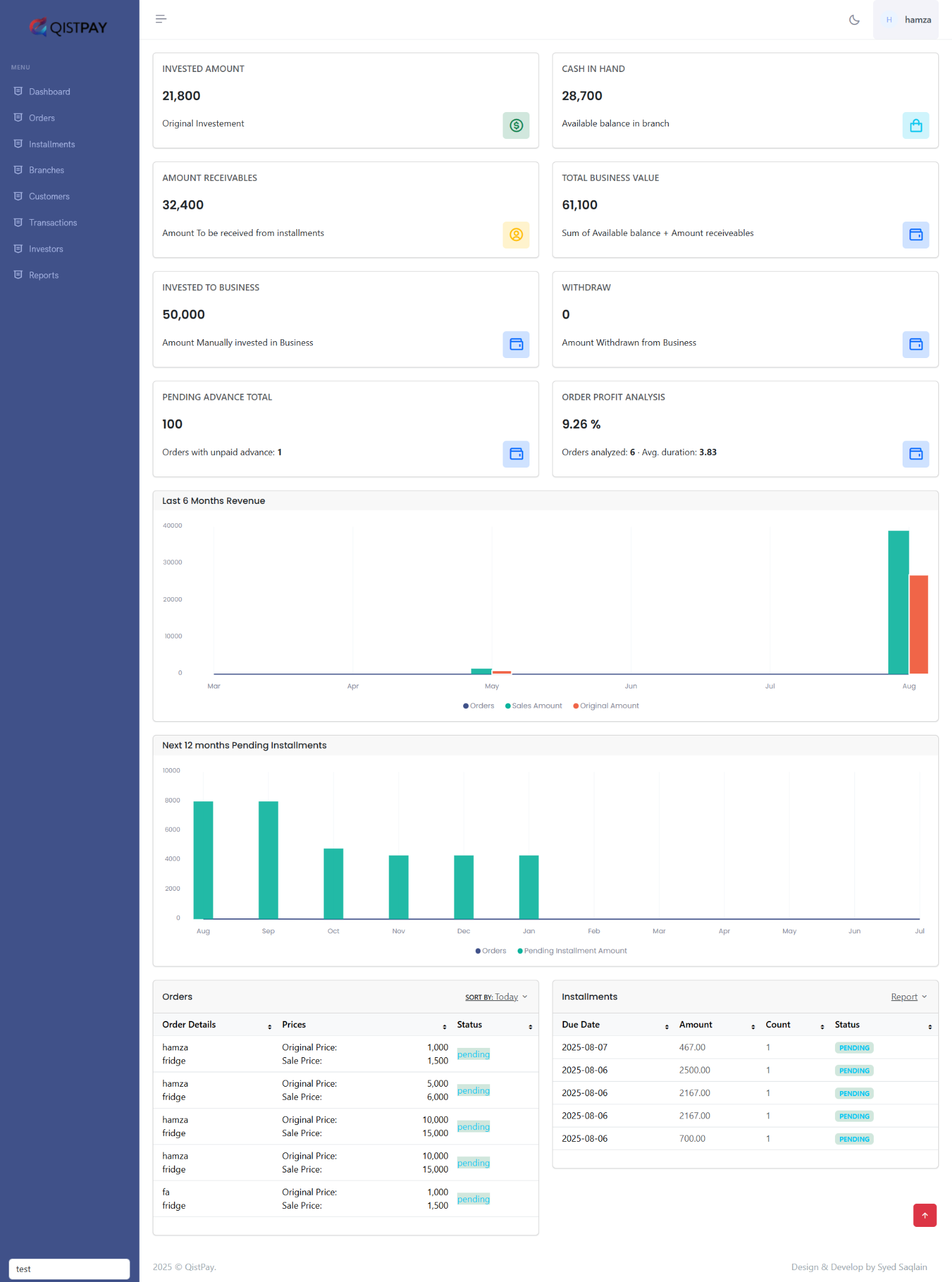

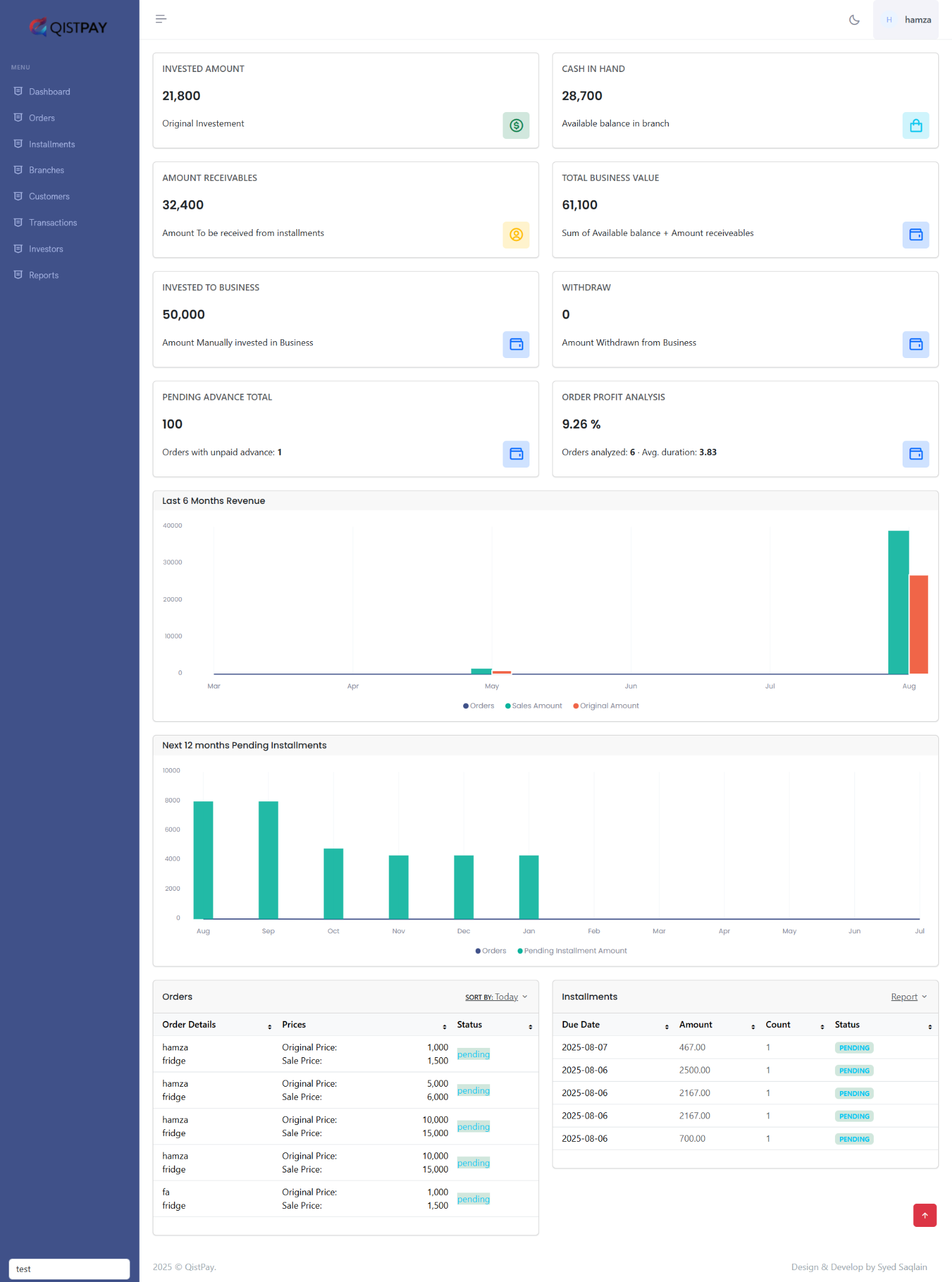

QistPay centralizes orders, monthly payments, branches, customers, investors and deep profit analytics—so you can grow with confidence.

QistPay centralizes orders, monthly payments, branches, customers, investors and deep profit analytics—so you can grow with confidence.

From a single appliance to a multi-branch network—QistPay adapts to your business.

Create orders for multiple items (fridges, ACs, more), set terms & advance, and generate schedules automatically.

Monthly plans, auto-reminders, overdue flags, partial payments, and penalty/discount rules—out of the box.

Track branch cash-in-hand, performance, and staff roles. Compare revenue & recovery across locations.

KYC, payment history, risk rating, and contact management—everything you need for responsible lending.

Cashbook, refunds, withdrawals, and inter-branch transfers with audit trails and exportable statements.

Manage investor capital, profit-sharing, payouts, and transparent performance dashboards.

Business value, recovery rates, profit/loss %, cohort trends, and export to Excel/PDF in one click.

Granular roles for admins, accountants, collectors & analysts. SSO-ready and activity logs included.

QistPay keeps your books tight. See cash-in-hand, receivables, pending advances, and month-over-month recovery at a glance. Profitability no longer needs a spreadsheet.

Add your branches, currencies, and user permissions. Import your existing orders (optional).

Enter items, set advance, decide duration. QistPay auto-builds monthly installments with due dates.

Collect payments, chase overdue, analyze P/L and recovery rate—then scale to new branches.

Have questions about modules, pricing, or deployment? Send a message and our team will get back to you.

Let our team set up your account, import your data, and train your staff.